At first glance, it doesn’t make sense. The United States spends more on healthcare than any other country in the world-yet when you walk into a pharmacy and pick up a generic pill like lisinopril or metformin, it often costs less than a cup of coffee. Meanwhile, in Germany or France, that same pill might set you back three or four times as much. How is that possible?

Americans Pay Less for Generics-Here’s Why

The U.S. doesn’t just have cheaper brand-name drugs. It has cheaper generic drugs too. According to a 2022 analysis by the U.S. Department of Health and Human Services, Americans pay about one-third less for generic medications than people in 33 other OECD countries. That’s not a fluke. It’s the result of a market built for volume, speed, and competition.

In the U.S., generics make up 90% of all prescriptions filled. That’s not because doctors prefer them-it’s because the system pushes them. Pharmacies automatically substitute brand drugs with generics unless a doctor specifically says no. In 49 states, pharmacists can swap out a brand-name drug for its generic version without asking the patient. That kind of pressure forces manufacturers to compete hard on price.

Big pharmacy chains and Pharmacy Benefit Managers (PBMs) buy generics in massive quantities. They don’t just want the lowest price-they want the lowest price every single time. That’s why you can walk into Walmart or CVS and pay $4 for a 30-day supply of generic atorvastatin. Some generics are even sold below manufacturing cost, just to keep shelves stocked and competitors out. That’s risky-when prices drop too low, manufacturers quit. Then, when only one company is left, prices spike. That’s happened with antibiotics, insulin, and even blood pressure meds. But overall, the system keeps prices low.

Europe’s System Is Built to Protect Prices

In Europe, the game is completely different. Only about 41% of prescriptions are for generics. Why? Because the system doesn’t push them. Governments set prices. They don’t let the market decide.

Take Germany. The government uses something called external reference pricing. That means they look at what other countries pay for a drug and set their own price based on the lowest few. If France pays €10 for a generic, Germany won’t pay more than that. But they also won’t pay less than what’s needed to keep companies from leaving the market. That creates a floor, not a race to the bottom.

In France, a pharmacist can’t switch a brand drug for a generic without the doctor’s okay. In the UK, the National Institute for Health and Care Excellence (NICE) decides whether a drug is worth the cost. If it’s not deemed cost-effective, it doesn’t get covered. That means even if a generic is cheaper, it might not be approved at all.

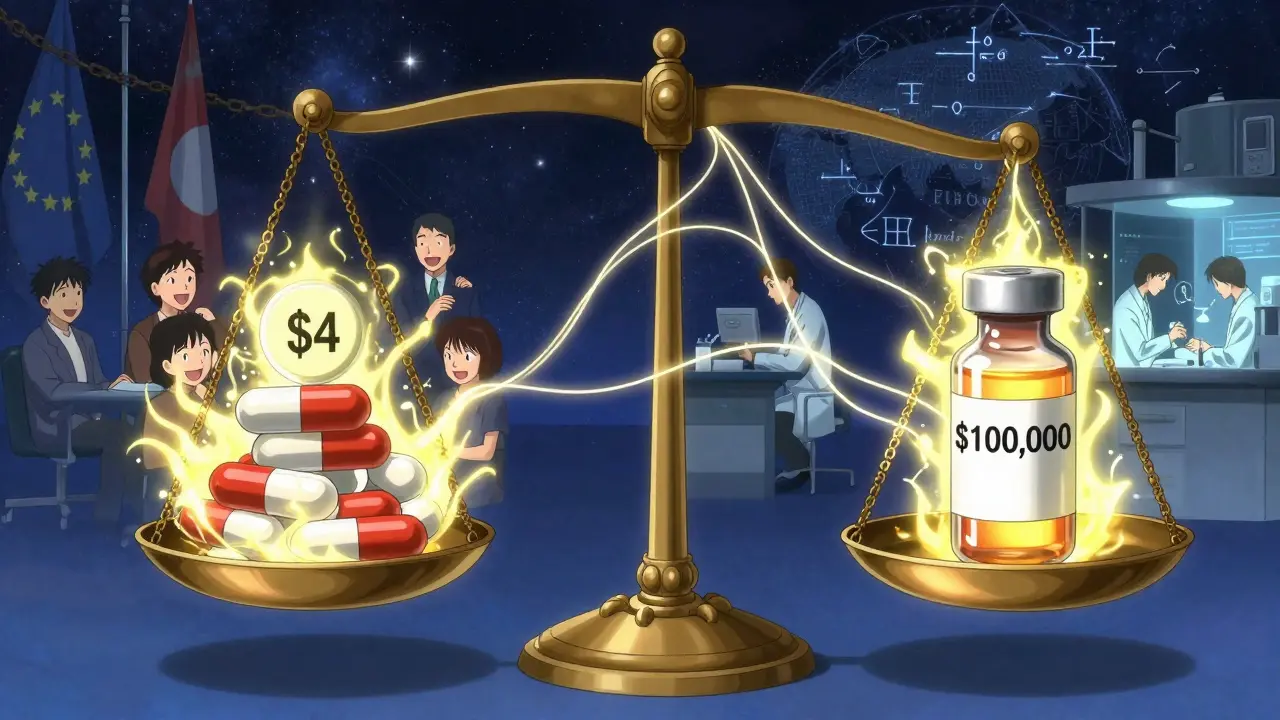

These rules protect manufacturers from brutal price cuts. They also mean fewer companies compete. With less competition, prices stay higher. In 2023, the average price for a generic prescription in European countries was $42.10. In the U.S., it was $28.50.

Why Brand-Name Drugs Are So Much More Expensive in the U.S.

Here’s the twist: while the U.S. wins on generics, it loses badly on brand-name drugs. Americans pay more than four times what Europeans pay for the same patented medication. That’s not because Americans are being ripped off. It’s because the U.S. is subsidizing global drug innovation.

Drug development costs billions. A single new medicine can take 10-15 years and $2.6 billion to bring to market. Companies need to recoup that. In Europe, governments negotiate hard. They say, “We’ll pay $10,000 for this cancer drug-or we won’t cover it.” In the U.S., there’s no such cap. Insurers pay whatever the list price is, even if it’s $100,000 a year. That’s why U.S. drug companies make more money here than anywhere else.

That extra money funds research. The IQVIA Institute found that the U.S. accounts for 40% of global drug sales but only 4% of the world’s population. And that 40% is what pays for 55% of all new drug discoveries between 2015 and 2023. Without those high U.S. prices, many new medicines would never be developed-or would be developed much slower.

That’s why European officials call it “free riding.” They get the benefits of innovation without paying the full cost. And for years, that worked. But now, the U.S. is trying to change that.

The Inflation Reduction Act Is Changing the Game

In 2022, Congress passed the Inflation Reduction Act. One part lets Medicare negotiate prices for 10 high-cost brand-name drugs. The first round of negotiations, finalized in 2024, cut prices for drugs like Jardiance and Stelara by up to 70%.

But here’s the catch: even after those cuts, Medicare’s prices are still higher than what European countries pay. Jardiance costs Medicare $204 per month. In other countries, it’s $52. Stelara is $4,490 in the U.S. versus $2,822 abroad. So even with negotiation, the U.S. isn’t catching up-it’s just lowering the ceiling.

What’s more, the law only applies to Medicare, which covers seniors. It doesn’t touch private insurance or the rest of the market. And it only applies to brand-name drugs. Generics? Still flying under the radar, still cheap.

What Happens When the U.S. Tries to Match European Prices?

There’s been talk in Washington about a “most favored nation” policy-meaning the U.S. would pay the same price as the lowest-paying country in the world. Former President Trump pushed this idea. So did some lawmakers in 2025.

But experts warn it could backfire. Alexander Natz of the European Confederation of Pharmaceutical Entrepreneurs says if the U.S. forces drugmakers to lower prices here, they’ll just raise them elsewhere to make up the loss. That means European prices could jump. And if companies can’t make money in Europe, they might stop launching new drugs there at all.

It’s a global supply chain. If the U.S. cuts its profits too hard, the entire pipeline slows down. New cancer drugs, Alzheimer’s treatments, diabetes medications-they all start with a lab in the U.S. If the money dries up, the innovation dries up too.

Real People, Real Prices

One Reddit user from Ohio wrote in January 2025: “I paid $4 for my generic lisinopril at Walmart. When I visited my cousin in Berlin, he paid €15 for the same thing. I thought he was joking.”

Another user from London said: “I was shocked when my brother visited from Chicago and said his insulin costs $30 a month. Here, it’s €120. We don’t even have a choice-it’s just the price.”

These stories aren’t outliers. A 2024 survey by the European Patients’ Forum found that 78% of Europeans think U.S. brand-name drug prices are “unjustifiably high.” Meanwhile, American seniors on Medicare say they’re grateful for low generic prices-even if they’re stuck paying hundreds for a brand-name drug.

The Bottom Line: Two Systems, Two Priorities

The U.S. and Europe aren’t just different in how they price drugs. They’re different in what they value.

The U.S. system prioritizes access and speed. Generics are everywhere, cheap, and easy to get. But that comes at a cost: fragmented insurance, hidden rebates, and occasional shortages when companies exit unprofitable markets.

Europe prioritizes fairness and sustainability. Prices are controlled. Innovation is protected. But access to generics is slower, and patients often pay more out of pocket-even for simple pills.

Neither system is perfect. But they both work-just in very different ways. The U.S. wins on generic prices because it lets the market run wild. Europe wins on brand-name fairness because it keeps the market in check.

And for now, that balance holds. Americans pay less for generics. Europeans pay less for brand names. And the world still gets new medicines-because someone has to pay for them.

Why are generic drugs cheaper in the U.S. than in Europe?

Generic drugs are cheaper in the U.S. because of intense competition and high volume. Over 90% of prescriptions in the U.S. are for generics, and pharmacies automatically substitute them for brand-name drugs. Pharmacy Benefit Managers and big retailers buy in bulk, forcing manufacturers to slash prices to stay in the game. In Europe, governments set prices, limit substitution, and protect margins-so competition is weaker and prices stay higher.

Do Americans really pay less for all drugs?

No-only for generics. For brand-name drugs, Americans pay 3 to 4 times more than Europeans. The U.S. is the world’s biggest payer for new medicines, funding most of the global research and development. Europe keeps brand-name prices low through government negotiation, but that means less revenue for drugmakers.

How does Medicare drug negotiation affect generic prices?

It doesn’t. Medicare negotiation only applies to brand-name drugs under the Inflation Reduction Act. Generics are already priced low by the market, so they’re not targeted. Even if Medicare negotiates lower prices for brand-name drugs, generic prices are unlikely to rise-because competition keeps them down.

Why do some generic drugs go out of stock in the U.S.?

When prices drop too low, manufacturers stop making them because they can’t profit. That’s happened with antibiotics, thyroid meds, and even blood pressure drugs. Once only one company is left, they can raise prices. Then shortages happen. It’s a cycle: too much competition → prices collapse → companies leave → monopoly forms → prices spike.

Will U.S. generic prices rise if drugmakers lose profits on brand-name drugs?

Not directly. Generic prices are set by competition, not by what brand-name companies earn. Even if U.S. brand-name prices fall due to negotiation, the generic market will keep running the same way: high volume, low margins, fierce competition. The only way generic prices rise is if manufacturers exit the market and supply shrinks.

Can I buy cheaper generics in Europe and bring them to the U.S.?

Technically, you can bring in a 90-day personal supply for yourself-but it’s not practical. European generics aren’t FDA-approved for sale in the U.S., so they’re not legally available here. Plus, prices in Europe are often higher than in the U.S. for the same drug. It’s cheaper-and safer-to just fill your prescription at a U.S. pharmacy.

Martin Viau

Let’s be real - the U.S. system is a free-market bloodbath, and generics are the scavengers picking up the scraps. Companies compete until they’re bleeding out, then one survives and jacks up prices. It’s not efficiency - it’s a rigged casino where patients are the house. Europe’s price floors? They’re not protecting profits, they’re protecting sanity.

Marilyn Ferrera

Generics are cheap here - yes. But only because the system doesn’t care if you run out of them next month. The market doesn’t care about continuity - only cost-per-pill. That’s not a feature. It’s a bug with a Band-Aid.

Robb Rice

It’s fascinating how the U.S. model relies on volume to drive down prices - but what happens when the volume drops? Supply chains fracture. One manufacturer goes under, and suddenly, a life-saving drug becomes a luxury. It’s not sustainable. It’s a house of cards.

Brandon Boyd

Look - if you’re paying $4 for lisinopril, you’re winning. Seriously. Most people in other countries don’t even know this is possible. Don’t get distracted by brand-name prices - focus on what’s in your hand right now. You’re getting life-saving meds for less than your morning coffee. That’s not luck - that’s American hustle.

Branden Temew

So the U.S. is the world’s drug R&D piggy bank? Cool. So why are we the only ones getting the bill? Europe gets the innovation, we get the debt. And we’re supposed to be grateful? I’d call it exploitation - if it weren’t so predictable.

Frank SSS

Remember when insulin was $30 here and €120 there? Now the U.S. is negotiating prices down - but only for Medicare. Meanwhile, private insurers still pay $1,000 a month. So who’s really getting screwed? The people who don’t qualify for Medicare. The system isn’t broken - it’s designed to leave you behind until you’re old enough to matter.

Paul Huppert

I’ve had both. Paid $4 for metformin in Ohio. Paid €38 for the same in Italy. I didn’t feel richer - I felt lucky. Maybe the real issue isn’t who pays less, but who gets to decide what ‘less’ means.

Hanna Spittel

EUROPE IS JUST FEDERALIZING DRUG PRICES BECAUSE THEY’RE TOO LAZY TO INNOVATE 😂💸 #USAWINS #FREEMARKETISLIFE

Brady K.

You call it competition. I call it predatory discounting. The U.S. doesn’t have cheap generics - it has a cartel of PBMs and Walmart that crushes small manufacturers until only the bottom-feeders remain. Then they raise prices. Rinse. Repeat. This isn’t capitalism - it’s capitalism with a death wish. And we’re all just waiting for the next insulin shortage.

Kayla Kliphardt

I wonder how many people realize that the reason generics are so cheap here is because no one’s tracking the long-term consequences. Like, what happens when a whole class of drugs disappears because no one can make a profit? Do we just… wait for the next patent to expire?

John Chapman

Low prices = more people taking meds = better public health. End of story. 🙌 If Europe wants to pay more to feel morally superior, that’s their thing. But don’t act like your system is better - it’s just slower and more expensive. I’ll take $4 pills over €40 any day.

Bennett Ryynanen

My grandma’s on 7 generics. Pays $12 a month total. In Germany, her cousin pays €200 for the same pills. She doesn’t get it. She thinks the U.S. is some kind of drug utopia. I just nod. I don’t have the heart to tell her the system’s one shortage away from collapse.

Sara Stinnett

Let’s be honest - the U.S. doesn’t have cheap drugs. It has a broken system that outsources its moral responsibility to the poor. You think $4 is good? It’s only $4 because the people who make it are underpaid, overworked, and living in countries with no labor protections. You’re not saving money - you’re exporting exploitation.

linda permata sari

As someone who grew up in Indonesia where generics cost less than a street snack - I’m not surprised. But what shocks me is how Americans treat this like a victory. It’s not a win. It’s survival. And the fact that we celebrate it means we’ve stopped expecting more.

Urvi Patel

The US system is the only one that actually works because it lets the market decide not some bureaucrat in Brussels who doesn't even know what a pill looks like